If you’re looking for best crypto tax software australia pictures information connected with to the best crypto tax software australia keyword, you have come to the ideal site. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Best Crypto Tax Software Australia. The court granted irs authority to serve summons to coinbase to gather its customer information for transactions that took place from 2013 to 2015. Use our crypto tax calculator to help plan & estimate your tax position in australia. Via phone or online, a friendly coffee or an email, we’re keen to help you get to the next level. A few of the best crypto tax software tools are:

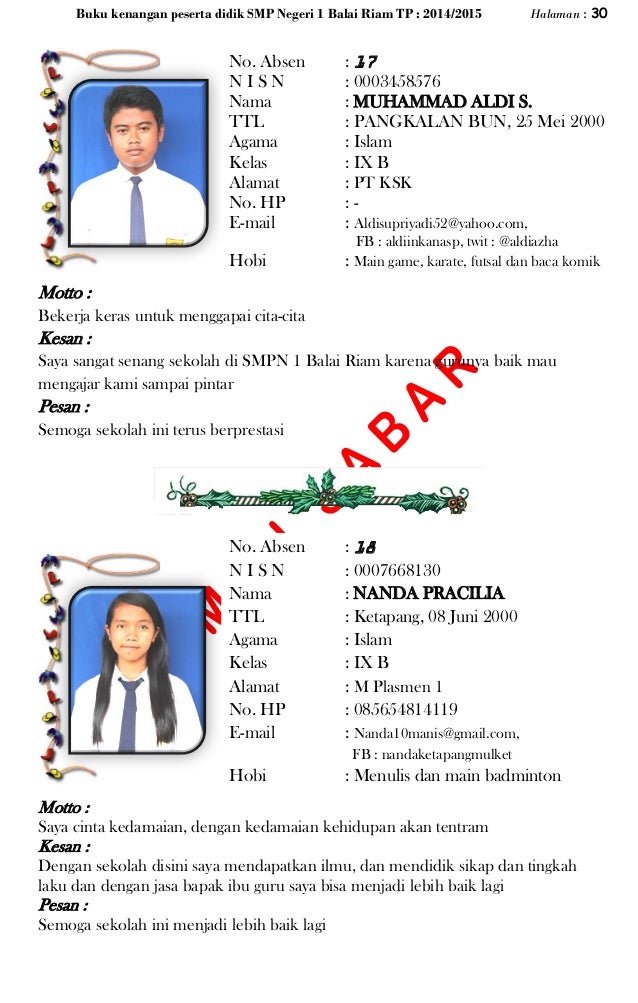

Bitcoin on a money tree, bark in background with 4 coins From pinterest.com

Bitcoin on a money tree, bark in background with 4 coins From pinterest.com

Kunci jawaban sd kelas 3 Kunci jawaban pts smp kelas 7 bahasa inggris Kunci jawaban sd kelas 3 tema 1 halaman 3 Kunci jawaban sejarah indonesia kelas 10 penerbit erlangga bab 2

Thousands of users in more than 20 countries already trust cryptotax. Tracks the current year�s gains and losses: Tracking of your current year�s gains and losses,. How does the crypto tax software work? Yes, there are several crypto tax software applications online to help track your trades and generate a capital gains report. Unsure how much tax may be payable for your crypto situation?

Start using crypto accounting software like cointracker, cryptotaxcalculator or koinly to ensure you’re ready to go the moment tax season rolls around.

Beartax is a trusted cryptocurrency tax software that makes the process of calculating, filling and reporting taxes super easy. How does the crypto tax software work? A few of the best crypto tax software tools are: Tracking of your current year�s gains and losses,. Beartax helps you to fetch trades from 50+ crypto exchanges, review and calculate capital gains or losses based on your transactions and. The annual subscription covers all previous tax years.

Source: pinterest.com

Source: pinterest.com

Personal use purchases with cryptocurrency (less then a$10,000) are excluded from taxes. The annual subscription covers all previous tax years. Are there crypto tax calculators, software or tools? A few of the best crypto tax software tools are: Cryptotax is the most reliable tax software for bitcoin, forex and cryptocurrency trading.

Source: pinterest.com

Source: pinterest.com

Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year. Tracking of your current year�s gains and losses,. Get in touch, however you would like. Via phone or online, a friendly coffee or an email, we’re keen to help you get to the next level. Simply import your transactions from your cryptocurrency exchanges into your account and generate the associated capital gains reports with the click of a button.

Source: pinterest.com

Source: pinterest.com

Tracks the current year�s gains and losses: Tracking of your current year�s gains and losses,. Use our crypto tax calculator to help plan & estimate your tax position in australia. Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year. The tax calculator developers have adapted it to consider the tax rules in australia and thus help traders prepare their tax return correctly.

Source: pinterest.com

Source: pinterest.com

The annual subscription covers all previous tax years. Use our crypto tax calculator to help plan & estimate your tax position in australia. Thousands of users in more than 20 countries already trust cryptotax. Contact us to ensure you are prepared for tax time and have the right strategy put in place. Yes, there are several crypto tax software applications online to help track your trades and generate a capital gains report.

Source: pinterest.com

Source: pinterest.com

Cryptocurrency tax software like cryptotrader.tax was built to automate the entire crypto tax reporting process. A few of the best crypto tax software tools are: Tracking of your current year�s gains and losses,. If you need to amend your tax returns from previous years you will be covered under the one plan. Tracks the current year�s gains and losses:

Source: pinterest.com

Source: pinterest.com

Each software can assist you to calculate your profit and loss to meet your tax obligations. You can use cryptocurrency tax software like cryptotrader.tax to calculate all of your gains and losses across all of your trades without requiring any manual work. Are there crypto tax calculators, software or tools? The software will also create international tax reports for filers outside the u.s. Looking at the best cryptocurrency tax software.

Source: pinterest.com

Source: pinterest.com

A few of the best crypto tax software tools are: How does the crypto tax software work? Use our crypto tax calculator to help plan & estimate your tax position in australia. Beartax is a trusted cryptocurrency tax software that makes the process of calculating, filling and reporting taxes super easy. Via phone or online, a friendly coffee or an email, we’re keen to help you get to the next level.

Source: pinterest.com

Source: pinterest.com

Simply import your transactions from your cryptocurrency exchanges into your account and generate the associated capital gains reports with the click of a button. If you’re a trader or are running a crypto business, you could be eligible to claim significant deductions on your regular income. Cryptocurrency tax software like cryptotrader.tax was built to automate the entire crypto tax reporting process. Thousands of users in more than 20 countries already trust cryptotax. Australia�s first crypto accounting and tax tool which has been vetted by a chartered accountant.

Source: pinterest.com

Source: pinterest.com

Crypto tax software tools will take the data and create tax forms like form 8949 (u.s. In this spider web diagram, you can visualize how each tool excels in the different categories. Beartax is a trusted cryptocurrency tax software that makes the process of calculating, filling and reporting taxes super easy. Crypto tax software tools will take the data and create tax forms like form 8949 (u.s. Best crypto tax software with tax reports features are:

Source: pinterest.com

Source: pinterest.com

Get in touch, however you would like. Crypto tax australia provides tailored and proactive cryptocurrency taxation advice to its clients, whether you are an investor or trader anywhere throughout australia. Cryptotax is the most reliable tax software for bitcoin, forex and cryptocurrency trading. In this spider web diagram, you can visualize how each tool excels in the different categories. The tax calculator developers have adapted it to consider the tax rules in australia and thus help traders prepare their tax return correctly.

Source: pinterest.com

Source: pinterest.com

The annual subscription covers all previous tax years. Simply import your transactions from your cryptocurrency exchanges into your account and generate the associated capital gains reports with the click of a button. Crypto tax australia provides tailored and proactive cryptocurrency taxation advice to its clients, whether you are an investor or trader anywhere throughout australia. Personal use purchases with cryptocurrency (less then a$10,000) are excluded from taxes. Cryptocurrency tax accountants and advisors.

Source: pinterest.com

Source: pinterest.com

Thousands of users in more than 20 countries already trust cryptotax. The court granted irs authority to serve summons to coinbase to gather its customer information for transactions that took place from 2013 to 2015. Crypto tax australia provides tailored and proactive cryptocurrency taxation advice to its clients, whether you are an investor or trader anywhere throughout australia. Tracking of your current year�s gains and losses,. The tax calculator developers have adapted it to consider the tax rules in australia and thus help traders prepare their tax return correctly.

Source: pinterest.com

Source: pinterest.com

Simply import your transactions from your cryptocurrency exchanges into your account and generate the associated capital gains reports with the click of a button. According to cryptotrader.tax, the user only has to import their trading history into the cryptocurrency tax calculator. Australia�s first crypto accounting and tax tool which has been vetted by a chartered accountant. The annual subscription covers all previous tax years. Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year.

Source: ar.pinterest.com

Source: ar.pinterest.com

Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year. The software will also create international tax reports for filers outside the u.s. Tracking of your current year�s gains and losses,. If you need to amend your tax returns from previous years you will be covered under the one plan. Best crypto tax software with tax reports features are:

Source: pinterest.com

Source: pinterest.com

Start using crypto accounting software like cointracker, cryptotaxcalculator or koinly to ensure you’re ready to go the moment tax season rolls around. Crypto tax software tools will take the data and create tax forms like form 8949 (u.s. The software will also create international tax reports for filers outside the u.s. Cryptocurrency tax accountants and advisors. How does the crypto tax software work?

Source: pinterest.com

Source: pinterest.com

If you need to amend your tax returns from previous years you will be covered under the one plan. The court granted irs authority to serve summons to coinbase to gather its customer information for transactions that took place from 2013 to 2015. Contact us to ensure you are prepared for tax time and have the right strategy put in place. Thousands of users in more than 20 countries already trust cryptotax. Tracks the current year�s gains and losses:

Source: pinterest.com

Source: pinterest.com

Tailored as per the ato guidelines, the algorithm provides an accurate report of your crypto gains/losses for a financial year. If you need to amend your tax returns from previous years you will be covered under the one plan. Unsure how much tax may be payable for your crypto situation? If you’re a trader or are running a crypto business, you could be eligible to claim significant deductions on your regular income. According to cryptotrader.tax, the user only has to import their trading history into the cryptocurrency tax calculator.

Source: pinterest.com

Source: pinterest.com

According to cryptotrader.tax, the user only has to import their trading history into the cryptocurrency tax calculator. Supports the ato tax rules. Looking at the best cryptocurrency tax software. How does the crypto tax software work? Are there crypto tax calculators, software or tools?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title best crypto tax software australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.